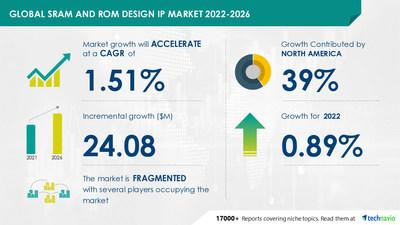

NEW YORK, May 11, 2022 /PRNewswire/ — The global SRAM and ROM design IP market size is expected to grow by $24.08 million from 2021 to 2026 at a CAGR of 1.51% as per the latest market report by Technavio. 39% of the market’s growth will originate from North America during the forecast period. The US is the key market for SRAM and ROM design IP market in North America. Market growth in this region will be faster than the growth of the market in other regions. Another key region offering significant growth opportunities to the vendors in APAC. The technological shift in the regional enterprises will facilitate the SRAM and ROM design IP market growth in North America over the forecast period.

For more insights on the market share of various regions – Download a sample report in MINUTES

Read the 120-page report with TOC on “SRAM and ROM Design IP Market Analysis Report by Type (SRAM and ROM) and Geography (APAC, North America, Europe, South Americaand Middle East and Africa), and the Segment Forecasts,2022-2026″. Gain competitive intelligence about market leaders. Track key industry opportunities, trends, and threats. Information on marketing, brand, strategy and market development, sales, and supply functions. https://www.technavio.com/report/report/sram-and-rom-design-ip-market-industry-analysis

SRAM and ROM Design IP Market: Vendor Analysis

The SRAM and ROM design IP market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market. The SRAM and ROM design IP market report offers information on several market vendors, including AnySilicon, Arm Ltd., Avalanche Technology Inc., Cadence Design Systems Inc., CEVA Inc., Design and Reuse SA, Dolphin Technology Inc, Edge AI, and Vision Alliance, eMemory Technology Inc., Everspin Technologies Inc., Infineon Technologies AG , Integrated Silicon Solution Inc., Microchip Technology Inc., Renesas Electronics Corp., Sperling Media Group LLC, STMicroelectronics NV, Surecore Ltd, Synopsys Inc., Toshiba Corp., VeriSilicon Microelectronics (Shanghai) Co. Ltd., and Xilinx Inc.. among others.

-

eMemory Technology Inc. The company offers SRAM and ROM design IP products such as NVM silicon IP platform NeoBit, NeoFuse, NeoMTP, NeoEE and NeoPUF

To know about all vendor offerings – Download a sample now!

SRAM and ROM Design IP Market – Drivers & Challenges

the faster processing speed is one of the key drivers supporting the SRAM and ROM design IP market growth. The speed at which a computer central processing unit (CPU) retrieves and interprets instructions is determined by the processor clock speed. This allows your computer to do more tasks in a shorter amount of time. SRAM is faster than DRAM since it does not have to refresh as frequently, as DRAM does. It has access periods of 60 nanoseconds in terms of seconds. In 10 nanoseconds, SRAM accomplishes the same task. It does not require an electric charge to be recharged. As the CPU does not have to wait for data from SRAM, it is faster than DRAM. The most typical application of SRAM is to act as a processor cache. Such increasing applications are driving the market growth.

However, the scaling issue of SRAM is one of the factors hindering the SRAM and ROM design IP market growth. SRAM scaling challenges are twofold-cell stability and physical area. SRAM Vmin is a function of transistor Vt mismatch, which is made up of two parts that include structural and random dopant fluctuation (RDF). To the first order, Vt mismatch is inversely proportional to the device/cell size. As a result, the larger the cell, the more stable it is. For instance, SRAM cell size scaling is limited by a few critical ground rules in terms of physical area difficulties,” stated Subramani Kengeri, vice president of advanced technology architecture at Global Foundries. However, to address the SRAM scaling problem, chipmakers face some tough processes and design choices.Such challenges faced by chipmakers will negatively impact the market growth during the forecast period.

To know about the other drivers & challenges – Download a sample now!

SRAM And ROM Design IP Market: Segmentation Analysis

Type Outlook (Revenue, USD mn, 2021-2026)

Geography Outlook (Revenue, USD mn, 2021-2026)

-

APAC – size and forecast 2021-2026

-

North America – size and forecast 2021-2026

-

Europe – size and forecast 2021-2026

-

South America – size and forecast 2021-2026

-

Middle East and Africa – size and forecast 2021-2026

To know about the contribution of each segment – Grab an Exclusive Sample Report

Don’t wait, Make a strategic approach & boost your business goals with our SRAM And ROM Design IP Market Forecast Report – Buy Now!

Related Reports:

-

the DRAM market share is estimated to increase by USD 111.71 billion from 2021 to 2026, at a CAGR of 16.89%. Download a sample now!

-

the programmable application-specific integrated circuit (ASIC) market share is expected to increase by USD 2.05 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 8.71%. Download a sample now!

|

SRAM And ROM Design IP Market Scope |

|

|

Report Coverage |

Details |

|

page number |

120 |

|

base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.51% |

|

Market growth 2022-2026 |

$24.08 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

0.89 |

|

performing market contribution |

North America at 39% |

|

competitive landscape |

Leading companies, competitive strategies, consumer engagement scope |

|

Companies profiled |

AnySilicon, Arm Ltd., Avalanche Technology Inc., Cadence Design Systems Inc., CEVA Inc., Design and Reuse SA, Dolphin Technology Inc, Edge AI and Vision Alliance, eMemory Technology Inc., Everspin Technologies Inc., Infineon Technologies AG, Integrated Silicon Solution Inc., Microchip Technology Inc., Renesas Electronics Corp., Sperling Media Group LLC, STMicroelectronics NV, Surecore Ltd, Synopsys Inc., Toshiba Corp., VeriSilicon Microelectronics (Shanghai) Co. Ltd., and Xilinx Inc. |

|

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for the forecast period, |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get customized segments. |

Table of Contents

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Five Forces Analysis

5 Market Segmentation by Type

6 Customer Landscape

7Geographic Landscape

8 Drivers, Challenges, and Trends

9 Vendor Landscape

10 VendorAnalysis

11 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Mayda

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

E-mail: media@technavio.com

website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/sram-and-rom-design-ip-market—39-of-growth-to-originate-from-north-america –evolving-opportunities-with-ememory-technology-inc-anysilicon-technavio-301544223.html

SOURCE Technavio