Hemera Technologies/AbleStock.com via Getty Images

Back in February, I warned investors of credit market tightening in “PDI: Credit Hemorrhaging Is Accelerating Into A ‘Global Credit Crunch’.” At the time, it appeared that, as the Federal Reserve ended its asset purchase program, there would be a broad decline in market liquidity and a potentially sharp increase in credit risk yield spreads. Since then, the fund (NYSE:POI) has seen continued declines while the US economy has entered another contraction. More recently, there have been sharp declines in the global stock and bond markets, signaling a substantial likelihood of an even sharper credit market contraction.

In my view, the popular high-yield investment fund PDI has excessive risk exposure to a tightening financial market. The fund has attracted significant investor interest due to its high 11-12% dividend yield, but looking at its assets, it seems some investors may not understand its potential downside risk. That said, PDI is now trading back near its 2020 lows, causing many investors to look to the fund as a possible dip-buying opportunity. While this appetite is understandable, looking at the data, it appears to me that the fund may have a significant downside in front of it. Of course, PDI’s situation has shifted since February as there have been considerable declines in the debt market, so it seems like a good time to look at the fund to assess its risk better and reward potential.

Mortgage Market Meltdown

While PDI does own a range of assets, it is highly concentrated in mortgages (30% of MV) and high-yield credit (24.5% of MV). Nearly all of its mortgage assets are “non-agency,” meaning that they are not protected in the event of widespread mortgage defaults, giving them a significantly higher credit risk. In many instances, non-agency mortgages are “jumbo loans,” which are non-conforming and have higher loan-to-value ratios. Notably, there need not be a spike in defaults for those assets to decline as it will only require an increase in “risk of defaults” (due to a recession or housing market tightening) to drop.

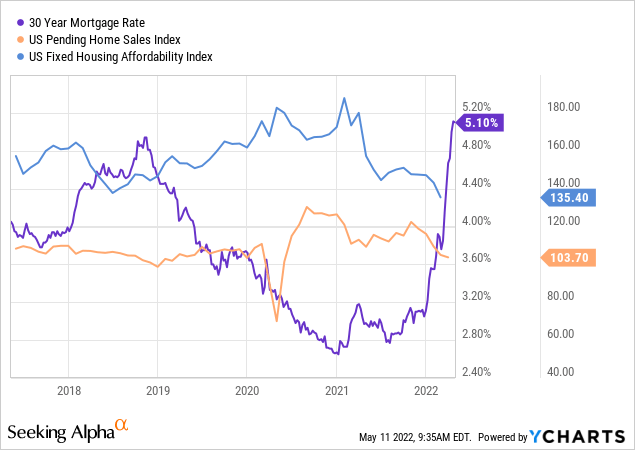

Considering non-agency mortgages are the largest segment of PDI’s assets, a tightening of the housing market is the most significant risk factor facing PDI. At this point, housing market tightening is virtually guaranteed as the massive jump in mortgage rates has rapidly broad pending home sales and home affordability back to low levels. See below:

Most non-agency mortgage assets decline proportionally to the rise in mortgage rates. Problematically, as mortgage rates rise, home sales (and likely prices) also usually fall. If national home prices slip and sellers struggle to find buyers, mortgage default risks will likely rise, causing non-agency mortgage credit risk spreads to increase as well. Put more simply, a considerable rise in mortgage rates may quickly spur a “doom loop” in the non-agency mortgage market. This type of scenario was experienced last from 2006 to 2010 and led to catastrophic losses for those owning non-agency mortgage-backed securities.

Today’s situation is different, but home affordability is nearly as low as it was then, and given the rapid pace at which mortgage rates have risen this year, it could prove to be worse today than it was then. Additionally, in the late 2000s, inflation was so low that the Federal Reserve and US government could quickly pursue dovish stimulative policies that saved the bottom from falling out of the mortgage market. With inflation much higher at 8%+, it is unlikely the government could rescue the market again without spurring an even worse hyperinflation crisis.

Corporate Credit Crumble

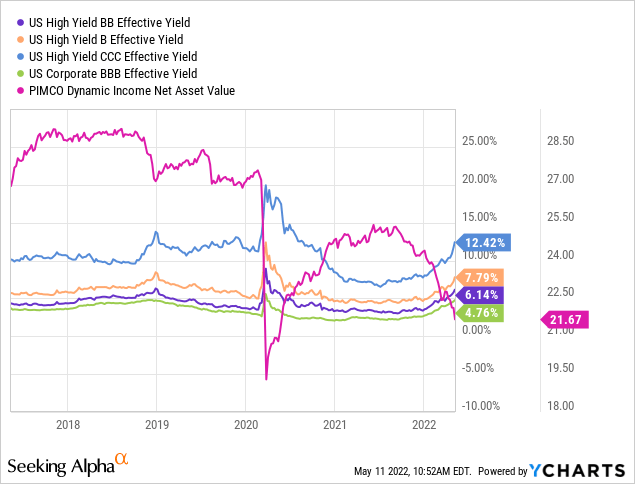

Aside from non-agency mortgages, the second-largest position in PDI today is high yield credit. These are bonds and other debt assets backed by companies with credit ratings below “investment grade” territory, meaning they carry higher yields and higher default risk. Looking at PDI’s industry exposure, it is apparent that no single industry has excessive allocation within the corporate credit space. However, non-investment grade credit assets generally fall the most during economic slowdowns. As you can see below, there has been a noticeable shock in low-grade credit rates this year:

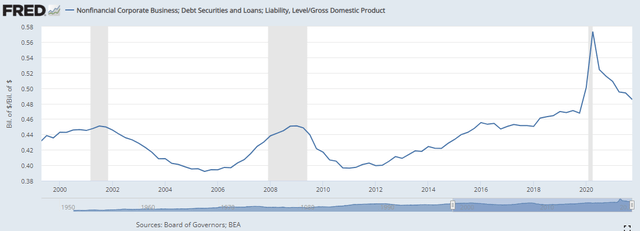

Just as with mortgage rates, as high-yield credit rates rise, PDI’s net asset value declines proportionally. On the one hand, higher credit rates increase PDI’s dividend yield. On the other, higher rates equal higher bankruptcy/default risk, which could result in permanent losses for PDI. Generally speaking, an economic recession will result in significant defaults that will cause permanent losses for PDI as some debt will never be paid in full. While there are many companies and industries in PDI’s debt portfolio, today’s ultra-high corporate debt-to-GDP level implies significant potential strain on corporate credit in an ongoing economic slowdown. See below:

Non-Financial Corporate Debt to GDP (Federal Reserve Economic Database)

Non-financial corporate debt-to-GDP was at typical “economic cycle peak” levels in 2019. Typically, when corporate debt-to-GDP is at ~50%, most companies are so heavily indebted that their cash flow and earnings are likely to decline. However, in 2020, the Federal Reserve’s effort to boost the market via rate cuts and QE and other stimulus efforts greatly aided companies and allowed them to refinance at lower rates. This effort led to an immense ~$2T increase in nonfinancial corporate debt issuance, and many of those bonds will reach maturity over the coming years.

The immense buildup in corporate debt since 2011 has been aided by the continued decline in borrowing rates until 2021. The ultra low-rate era allowed many companies to issue shorter-term bonds and repay them by reborrowing at lower interest rates. For the first time in years, interest rates are now firmly and substantially higher, so companies will either need to refinance at significantly higher rates (which they may not be able to afford) or find the cash to repay debt (which most do not have ). Of course, companies that do not have investment-grade status (ie, those PDI owns) will almost always have a worse ability to repay these loans due to poor cash flow and high debt.

Add on the impact of rising inflation and a slowing economy, and it seems highly likely that we will soon see a spike in corporate credit defaults which will likely lead to some permanent losses for PDI as companies are unable to meet obligations. This risk factor pertains to PDI’s high yield credit assets and its emerging market, CMBS, and likely some of its non-USD developed market debt assets. Around the world, there has been a colossal borrowing binge over the past decade fueled by low rates. As rates spike as the global economy slows, many companies will likely find themselves “swimming naked with the tide goes out.”

High Cost of Playing With Fire

Overall, PDI’s portfolio is increasingly precarious in today’s economic environment. While it is true that PDI’s yield has risen up to the 11-12% level, I do not consider this a “high return” given the 8-9% inflation rate today. After inflation and taxes, PDI offers minimal real yields for investors and substantial and immediate downside risk. To make matters worse, PDI is still trading at a 4.75% premium to its NAV as its NAV has declined at an accelerating pace in recent weeks.

It is true that if the tide reverses, PDI could see a strong rebound as the credit markets return to previous levels. Generally speaking, this seems unlikely when looking at today’s economic trends, valuations, and debt levels. At some point, likely after a recession, PDI could reach a bottom. Still, I personally doubt this will occur until there is a significant spike in corporate and potentially mortgage defaults. Such defaults could lead to irreversible losses for PDI as bankrupt entities cannot repay debt.

In the past, as in 2020 and 2008, the Federal Reserve had the means to create substantial new cash to “save” the financial market, leading to strong rapid rebounds for PDI (in 2020). However, with inflation as high as it is, the Federal Reserve will likely not be able to rescue credit markets again without risking hyperinflation. Thus, those who plan to wait for rescue and recovery may find no help.

The fund also has an effective leverage of 46%, which substantially magnifies its losses. In my view, borrowing money to “invest” in debt in highly indebted companies is hardly investing and is more akin to playing with fire. This is understandable for those with strong risk tolerance, but it is likely a faster way to lose wealth than to maintain it. Of course, we must keep in mind that PDI comes with an excessive 2.8% expense ratio between its borrowing expense (which will rise with the Fed funds rate) and its 2.04% total expense ratio (before interest). In my view, that is a high price to pay for a fund that has seen its NAV decline since inception (in 2013), particularly considering there have been stellar returns in most other assets from 2013 to today.