Grant Sabatier isn’t retired. But he could be.

One of the leading voices and biggest success stories in the FIRE movement — short for “financial independence, retire early” — the self-made millionaire has amassed enough money to live comfortably off income from his investments in perpetuity.

More from Grow:

How much you’d have now if you invested $1K at start of 2020 bull market

Supersaver who banked 78% of his income: How I did it

We wanted to make $1M, be our own bosses: Our side hustle made it happen

Sabatier views his situation as the end goal for people who think about money the way he does: not as something that allows you to buy things, but as a means of giving you more choices in how you want to live. “With every dollar you save, you give yourself more freedom and options in life,” he told Grow. “Based on how much you have saved and invested, ask yourself, ‘How many months of freedom have you acquired?'”

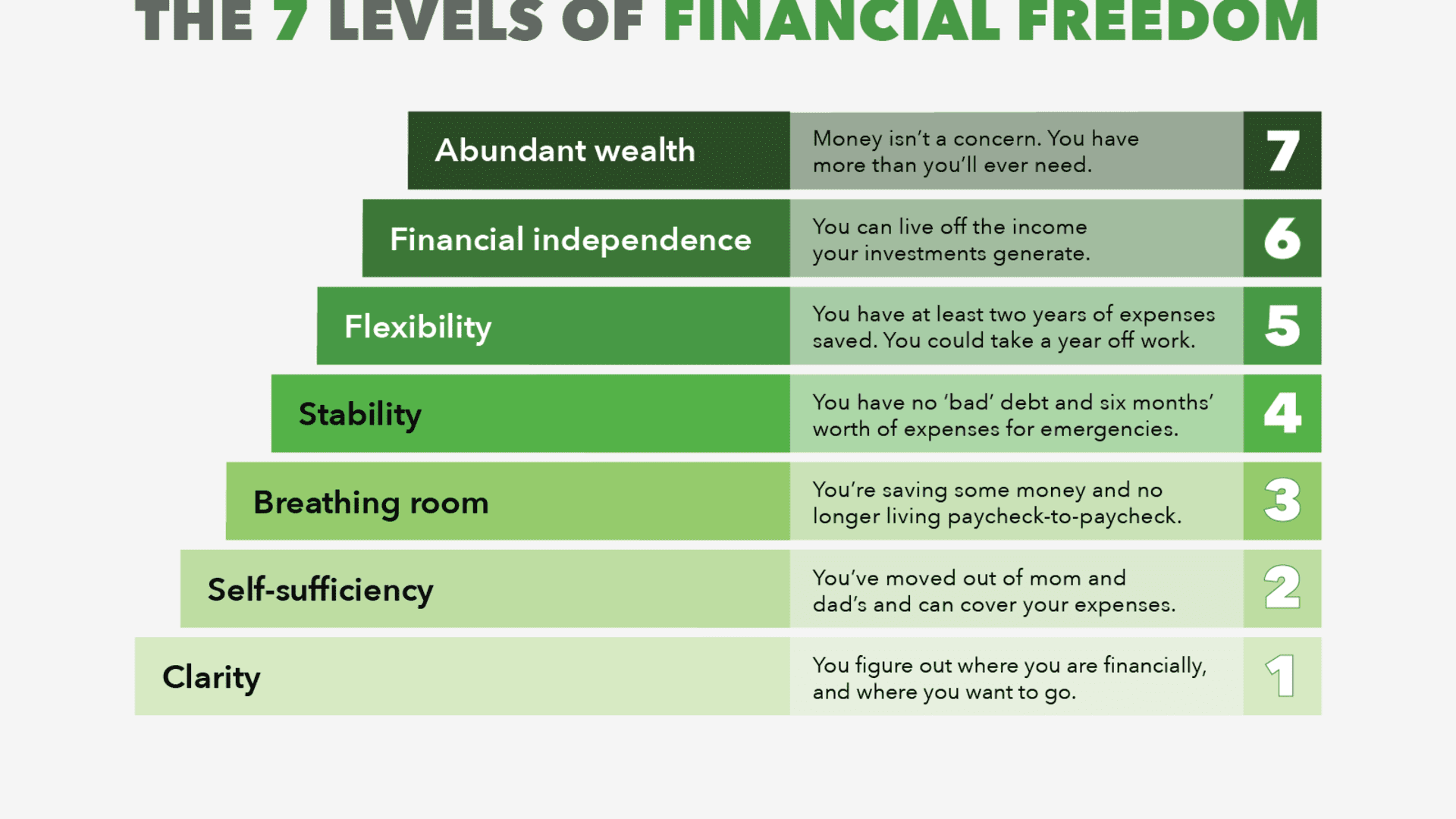

Rather than play golf or charter fishing boats, Sabatier has spent post-9-to-5 life in what he calls “a mission-driven phase.” In his book “Financial Freedom,” as well as in the Financial Freedom Course, an online personal finance curriculum, Sabatier offers a roadmap to money security which includes seven levels of financial freedom, ranging from Clarity all the way up to Abundant Wealth.

Half of working Americans say they live paycheck to paycheck, according to a recent MagnifyMoney survey, which puts them at Level 2, Self-Sufficiency.

Progressing through the levels likely requires a shift in your financial habits and overall thinking around money, Sabatier says.

Sabatier’s 7 levels of financial freedom

Level 1: Clarity

The first step is taking stock of your financial situation — how much money you have, how much you owe, and what your goals are. “You can’t get to where you want to go without knowing where you’re starting from,” Sabatier says.

Level 2: Self-Sufficiency

Next, you’ll want to be standing on your own two feet, financially speaking. This means earning enough to cover your expenses without any outside help, such as contributions from Mom and Dad.

At this level, Sabatier notes, you may be living paycheck-to-paycheck or taking on loans to make ends meet.

Video by Courtney Stith

Level 3: Breathing room

People at Level 3 have money left over after living expenses that they can put toward goals such as building an emergency fund and investing for retirement.

Escaping Level 2 means giving yourself some financial leeway, which Sabatier notes doesn’t necessarily mean making a much bigger salary. Indeed, 31% of working Americans making over $100,000 live paycheck-to-paycheck, according to MagnifyMoney.

“Just because you make a lot of money doesn’t mean you’re actually saving that money,” Sabatier says. “Most people in this country live through debt.”

Level 4: Stability

Those who reach Level 4 have paid down high interest rate debt, such as credit card debt, and have stashed away six months’ worth of living expenses in an emergency fund. Building up emergency savings helps ensure that your finances won’t be thrown off track by unexpected circumstances.

“At this level, you’re not worried if you lose your job or if you have to move to a different city,” Sabatier says.

Video by Stephen Parkhurst

When calculating how much you’d need to have saved, thinking about what your financial picture might look like you understand demanding circumstances, rather then your regular, everyday expenses, financial experts say.

“If you have a job loss, you’d make some changes. You’d probably cut your gym membership and get rid of your subscriptions, for instance,” Christine Benz, director of personal finance and retirement planning at Morningstar, told Grow. “Think about the bare minimum you’d need to get by.”

Level 5: Flexibility

People at Level 5 have at least two years’ worth of living expenses saved. With those kinds of savings, Sabatier suggests, you have the ability to think about your money terms of the time it can buy you: “You could take a year off from your job if you wanted to.”

You needn’t carry all of this money in cash, Sabatier notes: It could be a sum total from your savings and investment accounts. As long as you’re able to access that money somehow, if you need it, you have the flexibility to untether yourself, at least temporarily, from the workforce.

Level 6: Financial Independence

People who have achieved financial independence can live solely off the income generated from their investments, according to Sabatier’s framework.

“You generally have one of two things,” says Sabatier. “You either have a large pile of money in an investment portfolio that’s generating interest, or you have rental properties, and cashflow from the rent covers your living expenses, or a hybrid of the two.”

Video by Stephen Parkhurst

To get here, you’ll have to invest a high percentage of your income, which could require you to shift to a more modest lifestyle to drastically lower your cost of living. Pursuing this lifestyle requires a change in thinking away from the traditional paradigms of personal finance, Sabatier says.

“People are being taught to save 5%, 10%, 15% of their income, and maybe you’ll be able to retire when you’re 65,” he says. “Thankfully, more young people are starting to understand that if I aggressively save and invest, I can work less and have more control over my future and my destiny.”

Level 7: Abundant Wealth

Financially independent folks who live off their portfolio income rely on the “4% rule” — a retirement rule of thumb that posits that an investor can safely withdraw 4%, adjusted for inflation, from a balanced portfolio of stocks and bonds each year, and be relatively certain that the money will continue to grow and won’t run out.

Although economists debate whether 4% is the optimal number (some more conservative observers think the right figure might be closer to 3.3%), the calculation behind it serves as the basis for establishing a FIRE number — the amount of money you’d need to retire and earn an annual income you could comfortably live on.

More young people are starting to understand that if I aggressively save and invest, I can work less and have more control over my future and my destiny.

Grant Sabatier

author of ‘Financial Freedom’

While those in Level 6 need to monitor swings in their portfolio to make sure their retirement is still going according to plan, those in Level 7 have no such worries. “Level 7 is abundant wealth — having more money than you’ll ever need,” Sabatier says. “You don’t have to worry about money, and it’s not essential to your day-to-day existence.”

It’s the level where Sabatier finds himself, and the one he wants to get you to as well, if you’re willing to shift your mindset around money.

“If you want your life to look different, you have to make different choices,” he says. “Blueprints are available.”

The article “The 7 Levels of Financial Freedom, According to a Self-Made Millionaire — 50% of US Workers Are at Level 2″ was originally published on Grow (CNBC + Acorns).

.