If you’ve turned on a TV, listened to the radio, or surfed internet news sites recently you’ve almost certainly heard that there is a crisis, and a panic, about inflation.

You’ve been told it’s the reason the Federal Reserve is jacking up interest rates. It’s the reason the stock market has been plunging. It’s a political crisis as well as an economic one.

And everywhere you hear the usual yaks, yakking about soft landings and hard landings, whether the Fed is “behind the curve,” and whether we’re heading back to the 1970s era of “stagflation.”

There’s just one problem.

Somebody forgot to tell the financial markets.

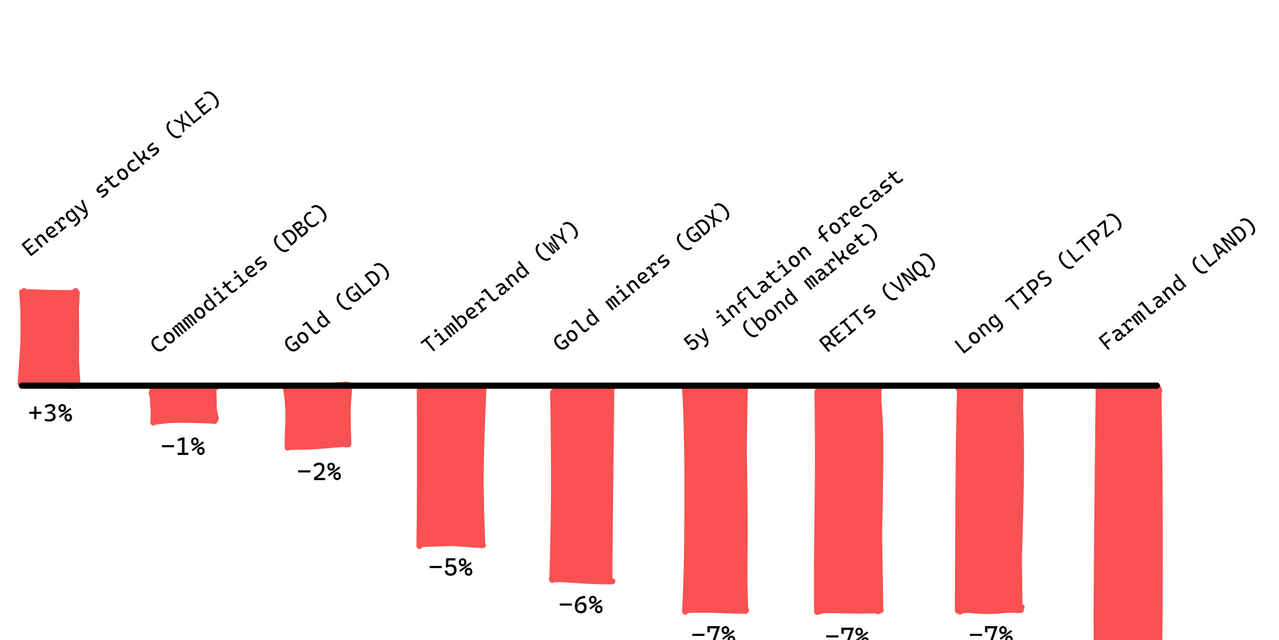

And I just checked, and while the yaks are yakking about runaway inflation, nine out of 10 inflation barometers in the financial markets are going down.

Check above.

If inflation expectations were skyrocketing, many, most or even all of these would surely be pointing upward. Instead the only one in the black for this month is the index of big oil stocks, and even then it’s pretty modest.

The bond market’s own forecast of inflation has been collapsing. At the end of April the bond market was predicting inflation to average 3.3% over the next five years. Today that’s down to 3.06%.

This is, or should be, very promising news for retirees, who are watching their fixed or semi-fixed incomes being eroded by recent price hikes.

It is, or should be, very promising news too for the rest of us, watching our 401(k)s turn into 201(ks). If stock markets are tumbling because everyone fears rising inflation and rising interest rates, anything pointing the other way has to be good news.

Meanwhile, economist Lutz Kilian at the Dallas Federal Reserve tells me that the month-over-month effect of oil prices on inflation has already passed its peak (for now, anyway). Lutz recently co-wrote a paper on this.

“We hypothesized WTI [crude oil] price of $102 in April 2022 (that’s already observed in the data) and $110 thereafter until the end of 2023,” Kilian tells me. “This scenario is effectively a no-change forecast based on the level of the oil price in early May 2022. We find that the monthly inflation rate associated with the observed and hypothesized gasoline price shocks peaks at 8.5 percent (expressed as an annualized rate) in March 2022, but drops to zero in April. It stabilizes near 2% at annualized rates later in 2022 and slowly declines back toward zero in 2023.”

Naturally he warns that analyzes need to be treated with caution and further changes to the oil market, for example by a total European ban on Russian oil and gas, would change the numbers.

Crude oil prices have fallen nearly 20% from their peak in early March. Sooner or later this will bring relief at the gas pumps.

As for a European embargo on Russian oil and gas? Your correspondent, who has been reporting on these things for a quarter-century, suspects that Russian oil and gas will find its way into the world market regardless.

.